Our accountants can help you setup and tailor your systems in order to fulfill the legal requirements of accounting in the most efficient way. We will also ensure that your accounts are prepared in a timely manner and that together we have minimised tax liabilities wherever appropriate.

Our Range Of Services Includes

Annual Accounts

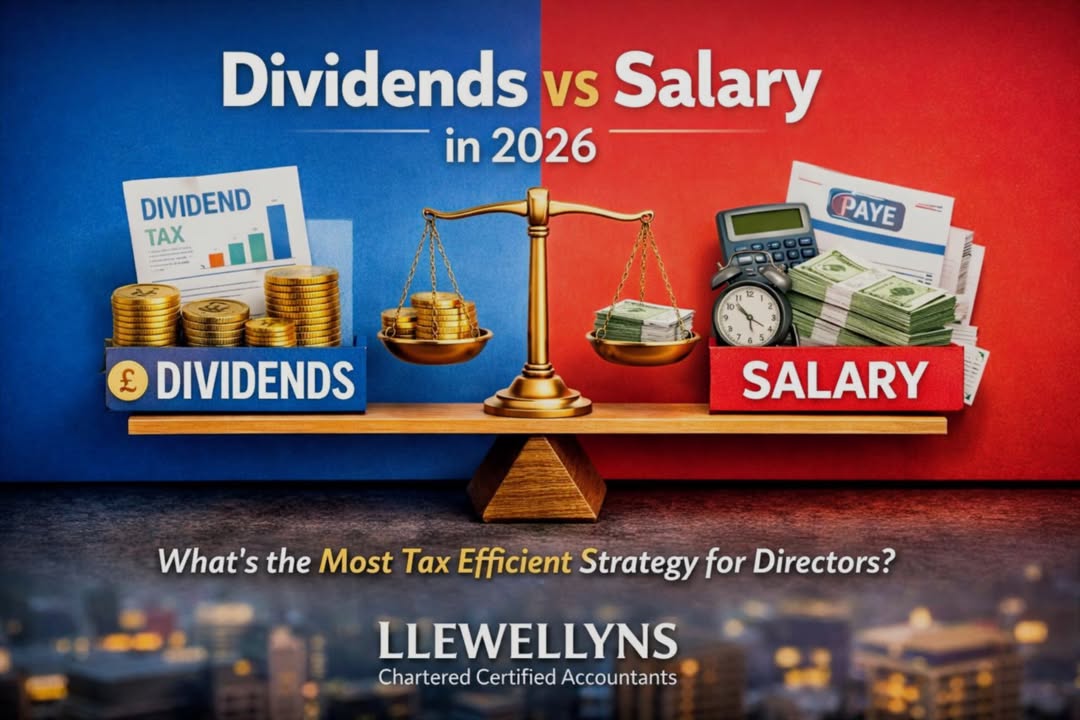

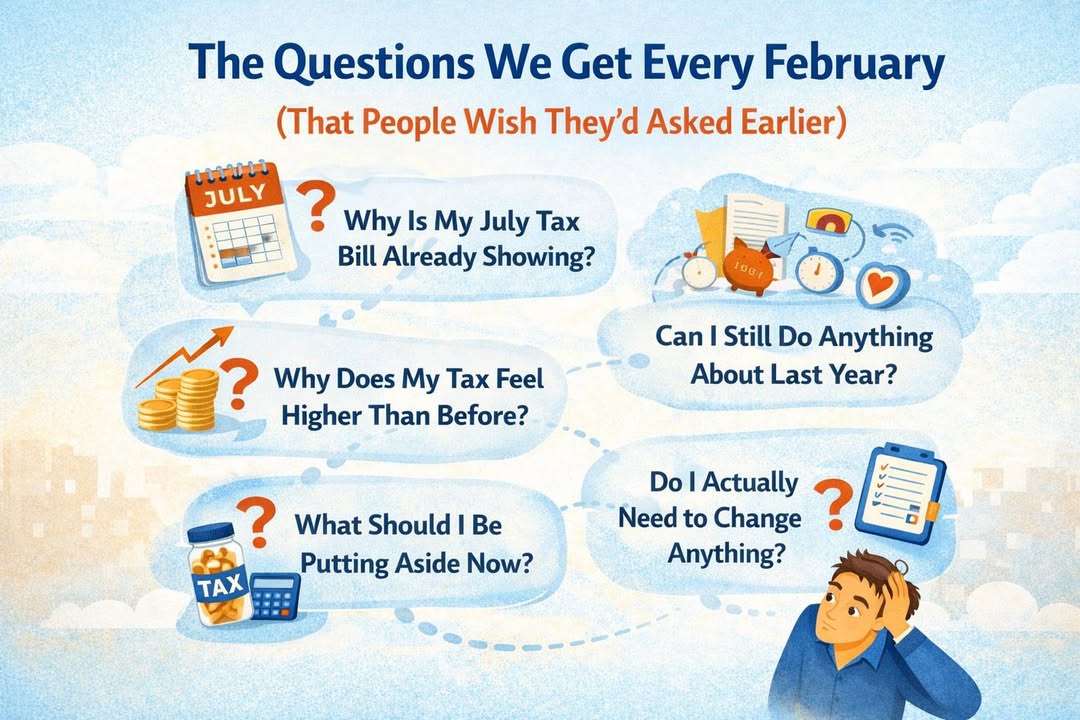

Tax Advice

At Llewellyns Accountants, our guidance will help you plan to minimise your future tax liabilities. Our staff will make sure you have claimed back everything that you can, and we will use our years of expertise to suggest alternative strategies for tax savings where appropriate.

Business Startup

We can guide you through your business formation. Our advisors will ensure all the appropriate legal documentation is completed and you have a firm financial strategy in place to successfully develop the future of your new venture.

Payroll

Our dedicated payroll team can remove the burden of running a fully compliant payroll system for your staff. We can fully manage the PAYE process and will work with the HMRC on your behalf to ensure you comply with all filing requirements and legal obligations.

Self Assessment

We deal with personal tax and self-assessment as well as businesses. Use us to ensure your returns are filed on time, and contain the right information to avoid any unnecessary tax burdens. We’ll keep your records straight and give you the tools to make keeping track of your finances as simple as possible.

VAT

Our experts in VAT can take care of this complicated tax for you and the administrative work it demands. We will ensure you don’t overpay VAT by delivering returns which are accurate and fully compliant with filing requirements and Making Tax Digital for VAT.

Auto-Enrolment

As auto-enrollment experts, we will guide you through the entire process from identifying suitable pension schemes, to enrolling your staff and operating your scheme. Our advice will ensure compliance with the rules set out by The Pensions Regulator.

Making Tax Digital

Making Tax Digital for VAT has come into effect in the UK, requiring all businesses to keep digital records. This can still be a challenge for many businesses, but with our expert help we can easily ensure you are fully compliant and gain the full benefits of digital accountancy.